THE CARES ACT – IMPLICATIONS FOR SMALL BUSINESS OWNERS

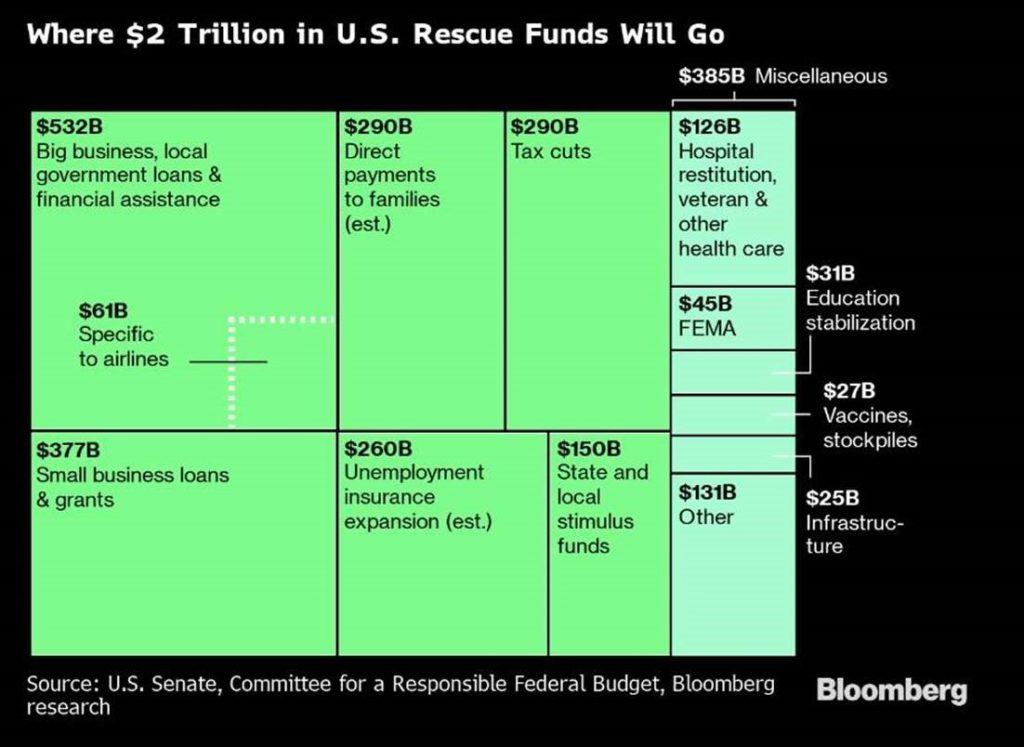

President Donald Trump has signed into law the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This unprecedented $2 trillion dollar stimulus and incentive package is part of a dramatic effort to mitigate the economic impact of the coronavirus pandemic. The direct stimulus payments to individual taxpayers and families have been much publicized, but a key component of this legislation is focused on helping protect American businesses and their employees.

In fact, nearly half of the allotted funds are reserved for business loans. A $500 billion pool has been set aside to provide emergency funds for businesses, though this is primarily intended for large corporations. Stipulations regarding executive compensation limits, and prohibition against share buybacks and dividend payments for one year after the loans are repaid, are contingencies for companies who opt to draw on these funds.

An additional $50 billion is specifically earmarked for consumer airlines plus another $100 billion to provide testing supplies, equipment, and additional payroll support for hospitals and healthcare providers.

But probably the most important aspect of this legislation is the piece that’s getting comparatively little media attention: around $350 billion has been appropriated to support small businesses. This is in addition to the $50 billion allotted to the Small Business Administration (SBA) through previous coronavirus stimulus efforts. Congress rightly sees this as an essential part of jumpstarting the economic recovery: businesses who are struggling with reduced cash flows need a way to sustain operations and retain employees while social distancing and shelter-in-place requirements are disrupting normal business practices.

Here are some of the provisions of the new Act aimed at helping small businesses and their employees:

DELAY OF ESTIMATED TAX PAYMENTS FOR CORPORATIONS

Estimated tax payments that come due after the legislation was enacted may be postponed until October 15, 2020 with no cap on the dollar amount of tax payments that may be delayed.

EMPLOYEE RETENTION CREDIT

Employers may receive a refundable payroll tax credit equal to the lesser of 50% of qualified wages or $5,000 per employee for wages paid to employees after March 12, 2020 and before January 1, 2021 if business activities were disrupted or suspended due to any government-imposed restrictions related to containing the spread of the virus.

Businesses whose operations were not disrupted, but experienced a decline in revenue due to the virus, can also receive the same credits if gross receipts fell 50% as compared to the same quarter in the previous calendar year. Credits will continue until gross receipts exceed 80% of the same quarter’s gross receipts in the previous year.

Eligibility is further contingent based on the level of disruption relative to the number of employees.

SOCIAL SECURITY PAYROLL TAX RELIEF

For self-employed individuals and business owners who continue to employ workers through the crisis, the Act includes provisions to provide a deferral of the employer-paid 6.2% Social Security payroll tax until January 1, 2021; half of the deferred liability would be due on December 31, 2021 with the remainder due December 31, 2022. Self-employed individuals must still pay their individual portion of their Social Security tax as usual.

Default on unpaid payroll tax liabilities can carry stiff penalties, including jail time, so business owners should exercise extreme discipline if taking advantage of this provision.

MODIFICATION FOR NET OPERATING LOSSES (NOL) AND ALTERNATIVE MINIMUM TAX (AMT) CREDITS

Provisions in the Act reduce the limitations on how a company can deduct operating losses from prior tax years. The Act temporarily eliminates the taxable income limitation to allow NOL’s to fully offset income while at the same time allow a loss from 2018, 2019 or 2020 to be carried back five years to reduce income in a prior tax year. This enables companies to generate additional cash flow from a refund of previous tax payments by using losses to amend prior years’ tax returns. This provision has been extended to also apply to pass-through businesses and sole proprietors.

Businesses may also accelerate the recovery of any remaining AMT tax credits to generate additional cash flow.

INCREASED INTEREST EXPENSE DEDUCTION

The Act temporarily increases the amount of interest expense that business owners may deduct from 30% to 50% of earnings (EBITDA) for 2019 and 2020. This is intended to help reduce the burden of carrying or taking on additional debt needed to weather the crisis.

BUSINESS INTERRUPTION LOANS

Businesses were eligible to receive up to $2 million under the Phase 2 aid package previously authorized by the federal government once the coronavirus outbreak was declared a federal disaster. These loans are still available to any small-business owner. In addition, provisions in the Phase 2 package required all business loans to offer a 90-day interest-only payment schedule, but only if the lender receives the request specifically from the borrower.

The Act includes provisions for a third phase of loans to businesses with 500 or fewer employees to help make payroll and prevent layoffs. Individual loans will be issued at interest rates up to 4% in amounts to cover six weeks of payroll with a maximum of $1,540/week per employee. The maximum amount a business can borrow is the lesser of $10 million or 2.5x the average total monthly payroll cost for the previous year. Payroll costs from January 1 to February 29, 2020 are used to calculate the total amount for businesses that were not in operation in early 2019. The principal of the loans will be forgiven if the funds are used for certain approved purposes – such as payroll, mortgage interest payments, rent, and utilities – and employers maintain the average size of their full-time workforce from the time they received the funds. This means that business owners who used the funds in the intended manner would only have to pay back the accrued interest on the loan. Any reduction in employee headcount, or a 25% or greater reduction in employee compensation, will reduce the amount of principal forgiven.

Applications and distribution of funds will be processed through banks to increase the speed of deploying capital and to limit stressing the resources of the SBA. Additional government lending agencies, including a Main Street Business Lending Program created by the Federal Reserve, will be established to meet the needs of borrowers as well. Applicants will need to verify payroll amounts from the previous 6 weeks and verify that payments to employees had taken place for eight weeks after receiving the funds.

For businesses with existing SBA loans, interest and principal payments will be waived for six months.

THE BIG PICTURE

The government is pulling out all the stops to help businesses and their employees overcome the short-term effects of the crisis until they can resume their path to long-term success. This is resulting in an unprecedented array of tax benefits, loan programs, and incentives through private lenders and public institutions. Business owners should remain in close contact with their lenders and tax professional to identify the options and solutions that provide the best outcome for both their company and their employees.

This content is from one of our Partners, Creative Planning, Inc.

This commentary is provided for general information purposes only and should not be construed as investment, tax or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

Individual Planning with the CARES Act

WHAT $2 TRILLION IN STIMULUS MEANS (OR DOESN’T) TO YOU!

On Friday, March 27th, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The CARES Act is the third piece of legislation passed by Congress to help stimulate the US economy due to the effects of COVID-19. This is the largest stimulus package in modern history, totaling $2 trillion in funds for individuals and businesses in the United States.

CHECKS ON THE WAY

The biggest headline of the Act is the $290B of stimulus payments that are to be sent directly to individuals. The base amounts are $1,200 per taxpayer ($2,400 for a married couple filing a joint tax return) and $500 per child.

If you are single and make less than $75,000 in 2020, you will receive $1,200. If you make over $99,000, you will get nothing. For a single filer, the $1,200 starts to phase out when adjusted gross income (AGI) exceeds $75,000. The payment is reduced by $5 for every $100 of income over the limit, completely phasing out for individuals with $99,000 of income.

If you are a married couple and make less than $150,000, you receive $2,400. If you make over $198,000, you will get nothing. For married couples filing jointly, the $2,400 begins to phase out when AGI exceeds $150,000. The payment is reduced by $5 for every $100 of income over the limit, completely phasing out for married couples filing jointly with $198,000 of income.

If you are single or married, you get $500 for each child, subject to the same phase outs and limits above.

While the payments will ultimately be based on your 2020 AGI, 2019 AGI is initially being used to determine eligibility. If your 2019 return has not yet been filed, 2018 will be used. So what if you don’t file taxes at all but collect social security? Not to worry! The IRS will determine your eligibility by looking at your social security benefits.[1] The timing of the payments is not yet determined, but the Act instructs the IRS to send payments “as rapidly as possible.” [2]

It’s hard to top free money being sent to you, but here are some other provisions:

401K WITHDRAWALS

The new law includes a waiver of the 10 percent early withdrawal penalty on retirement account distributions of up to $100,000 for taxpayers facing virus-related issues. Eligible accounts include IRAs, 401(k)s and other qualified trusts, certain deferred compensation plans and qualified annuities. The withdrawals are taxable over three years, and taxpayers are able to contribute the withdrawals back into the retirement account within three years, without impacting other contribution limits.

CHARITABLE TAX BREAK

The law includes an above the line $300 charitable contribution deduction for filers taking the standard deduction, and expanded limits on charitable contributions for those who do itemize. If you have been considering charitable giving, 2020 may be a great year to start and get a tax benefit you otherwise might not receive. If you already donate, 2020 may be a great year to consider a larger contribution to a donor advised fund.

MINIMUM REQUIRED DISTRIBUTIONS NOT REQUIRED IN 2020

The law includes a waiver of required minimum distributions for certain retirement plans in calendar year 2020. If you currently take automated withdrawals from your retirement account to satisfy a required minimum distribution, we recommend canceling the automated withdrawals, and skipping withdrawals altogether, to allow the funds to continue to grow tax deferred.

YOUR HEALTH INSURANCE AND COVID-19

The law requires that all private insurance plans cover COVID-19 treatments and vaccines, and requires that COVID-19 testing be included for free.

STUDENT LOAN BREAKS

The law includes the temporary suspension of payments for federal student loans until September 30, 2020. During this time, interest will not accrue. This creates a great opportunity for those with student loans to temporarily redirect those payments into an investment or retirement account and participate in the eventual market recovery, or make additional payments on higher interest debt in lieu of the student loan payments.

Also under the law, a portion of employer paid student loans are temporarily not taxable. Normally, if an employer makes student loan payments on behalf of an employee, the employee must claim the payments as taxable income. Under the CARES Act, employers can contribute up to $5,250 per year towards student loans and the payments are not included in the employee’s income.

EXPANDED UNEMPLOYMENT INSURANCE FOR WORKERS.

This includes a $600 per week increase in benefits for up to four months, and now includes workers that are not usually eligible for unemployment insurance such as the self-employed, independent contractors and those with limited work history. The new law also provides a 13-week extension of unemployment insurance.

With such sweeping provisions, all Americans at some level will economically benefit[3]. The CARES Act is one of the largest economic plans every to come out of Congress.

Thoughts from an ER Doctor on the Front Lines…

Thoughts from an ER Doctor (Dr. Ara Suppiah) His top recommendations to stay healthy and fight off this virus:

1) 20 minutes of sun daily. Natural Vit D is a game changer. Jump outside and get some SUN! Supplementation may also be a good bet. I personal use this combination of Vitamin D/K2.

2) Exercise and move! According to the doctor, our immune systems are at our highest for up to 2 hours after working out. This could mean take a walk or these simple body exercises . Of course check with your doctor to make sure you’re ok to do these exercises.

3) SLEEP. Yes, getting at least 7 hours of sleep. From 2-4am, according to the Doctor, is when our immune gets prepared ready to fight

4) Elderberry, 700-1000 ml (Only for 12 weeks) and Zinc Acetate (Don’t chew it!!). Again check with your personal doctor and you should be able to find both on Amazon

5) Wash your hands!!

Flatten the curve with your dinner plate. Antioxidants, allicin and zinc are just a few of the dietary compounds that may reduce excess inflammation and tissue damage caused by COVID-19. Here’s a list of foods that may help boost your immune system, assembled by experts including former US Secretary of Agriculture Dan Glickman. (CNN)